P&R proposes major overhaul of rules that guide all States’ spending; structural deficit estimate rises to £98m. as a result

- The Policy & Resources Committee has published a review of Guernsey's Fiscal Policy Framework.

- The Framework aims to ensure long-term financial stability through four key principle based pillars, moving away from rigid rules currently in place.

- It results in the structural deficit for 2026 being recalculated at £98m.

- Capital spending on major projects would be greater under the new rules

The Policy & Resources Committee has proposed a complete revision of rules that guide States’ spending, including upping how much is spent on major projects.

If adopted by the States, the new principles-based Fiscal Policy Framework would replace the island’s central financial objective, changing the focus from "permanent fiscal balance" to "long-term financial sustainability".

The proposed changes have a consequential impact on key financial metrics, increasing the estimated structural deficit for 2026 from £77 million, as calculated under the previous framework, to £98 million.

This all underpins upcoming decisions on things like GST and corporate taxation.

Deputy Gavin St Pier, Vice-President of the Policy & Resources Committee, stated: “This is our highest level of fiscal policy and defines what good management of our finances should look like over the long-term.

“It gives us a framework against which we can determine whether our finances are heading in the right direction.”

He continued, “In agreeing the Framework, we are agreeing what the goal for our finances should be. However, we know that as things stand there are areas where we are not meeting those objectives.

“In agreeing the Framework, we are also committing to return Guernsey to a stable and sustainable financial position, including rebuilding our reserves in the medium to long-term.”

The shift in financial philosophy

The review of the Framework was initially triggered by technical changes related to the methodological calculation of GDP and changes to the accounting presentation of the States' finances following the implementation of International Public Sector Accounting Standards (IPSAS).

The new Framework aims to define core and universal principles for financial management that are less rigidly bound to specific metrics.

The proposed Framework is built around the central principle of long-term financial stability, underpinned by “four interdependent pillars”.

1. Balanced income and expenditure: Ensuring revenues cover operational costs, fund investment, meet debt obligations, and build reserves

2. Sustainable infrastructure investment: Maintaining and developing public assets to support economic growth

3. Sustainable and well-managed debt: Using borrowing strategically to support long-term investment while preserving fiscal flexibility

4. Healthy financial reserves: Maintaining robust reserves to provide resilience against economic shocks and meet long-term obligations

Neglecting any one of these pillars would leave the States’ finances and the island’s economy exposed to ongoing vulnerability, P&R said in its report.

Why the deficit estimate increased

The proposed Framework requires a different approach to calculating the structural deficit, leading to the estimated increase from £77 million to £98 million in 2026.

The calculation of the structural deficit involves applying a series of adjustments to the accounting Net Surplus/Deficit to reflect the underlying financial position.

The key methodological differences driving this larger deficit estimate are:

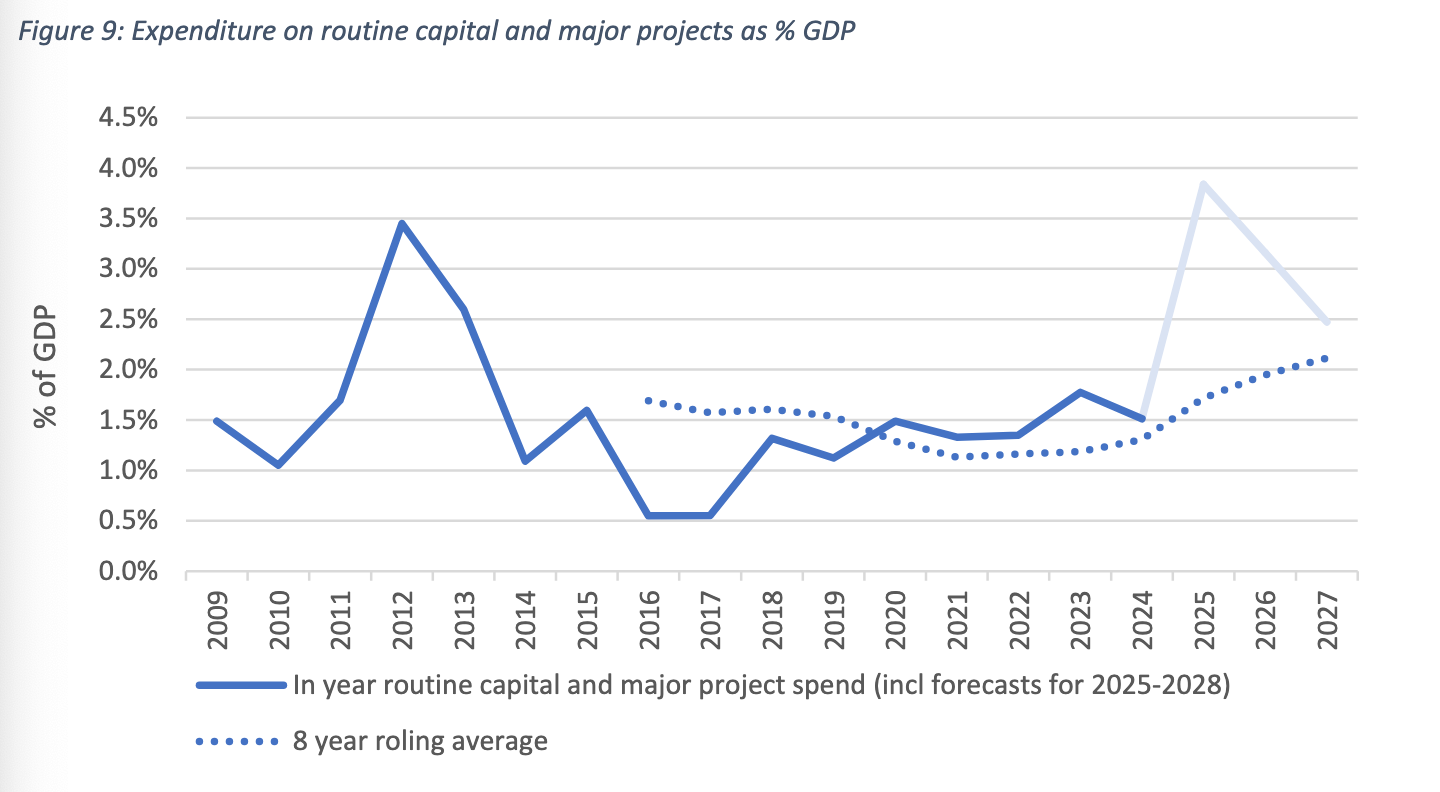

Increased infrastructure provision: The revised framework proposes increasing the planning assumption for necessary long-term provision from General Revenue required to sustain infrastructure and major capital investment, raising it from 2% of GDP to 2.3% of GDP. This change accounts for a net negative impact of £12 million. The overall recommended investment target is an average of 3% of GDP per annum. The remaining 0.7% is expected to come from States-owned ports and utilities.

Social security liability recognition: The Framework recommends revised treatment of the Social Security Funds by including their long-term funding requirements (recognising their liabilities) rather than focusing only on the in-year operational deficit. This commitment makes a net negative impact of £9 million.

Key commitments if adopted

The proposed Framework sets out specific long-term goals for investment, debt, and reserves.

Infrastructure investment

The States have historically struggled to meet investment targets, routinely falling short of the previous principle of investing 2% of GDP.

To address this, the P&R Committee is seeking a directive to develop a Long-Term Strategic Infrastructure Framework.

This framework is intended to ensure a consistent flow of investment and prioritise major projects that meet the planning assumption of investing an average rate of 3% of GDP per annum.

Reserve management

The proposal recommends that total reserve holdings (including the Core Investment Reserve, General Revenue Reserve, and Social Security Funds) be maintained at no less than 43% of GDP (the estimated level for 2024), with a strategic objective to increase this to 50% of GDP over the long term.

The current policy target is for the Core Investment Reserve is to hold 100% of General Revenue expenditure, which would require an almost four-fold increase from its current £182 million.

“Independent analysis by the Fiscal Policy Panel suggests that to provide a contingency sufficient to absorb the impact of exceptional events – such as the collapse of the banking systems in both Iceland and Cyprus – the Core Investment Reserve would need to be increased to between 30% to 60% of GDP.

"This equates to a target range of £1bn to £2bn, a level that would take decades of sustained surpluses to reach,” the report says.

Debt management

The Framework emphasises that long-term debt should only be used to fund infrastructure investment within the States Group, and not to fund operational activities

Debt levels must remain within “appropriate, independently assessed limits”.

This replaces the rigid debt rule of its not exceeding 15% of GDP.

An assessment conducted in 2023 indicated that debt liabilities could be sustained up to 30% of GDP without adversely impacting the island’s strong credit rating.

As of December 2024, the States’ total debt (including group entities) stood at an estimated 11% of GDP. This includes the States’ only long-term debt - a £330m bond issued in December 2014, which matures in 2046.

It has proposed that the independent Fiscal Policy Panel provides oversight of States' compliance with the rules.

The Policy & Resources Committee intends to report back to the States in the first half of next year with the findings of the Tax Review Sub-Committee as members decide whether or not to introduce a GST.

Comments ()