In a Budget of few surprises spending grows above inflation, help is targeted at rental sector and eyes are fixed on forthcoming decisions on GST

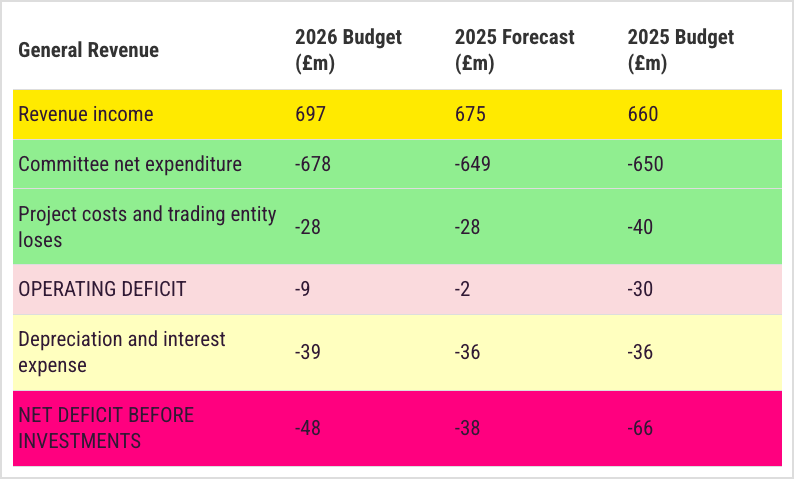

- The 2026 Budget results in a net deficit before any investment returns of £48 million.

- Proposals include an increase in the personal income tax allowance to £15,200.

- Committees get £29.4m. more to spend than last year (4.5% up).

- Proposed tax increases include excise duty on tobacco and fuel, a new duty on vaping liquid, and hikes to vehicle first registration.

- A savings target of £4 million has been set.

This year’s Budget could result in £48m. being eroded from the island’s savings as it plots the course to major decisions on increasing income later next year.

People will benefit from a £600 increase in the amount of money you can earn before income tax is applied to £15,200, but pay with increases in tobacco (up 13.3%, or £1.14 per pack of cigarettes), fuel (4.3%, 3.7p on a litre of petrol) and domestic property tax (8.3%).

A new duty on vaping liquid is being introduced in line with the UK, set at £2.20 per 10ml.

Committees have been set a savings target of £4m., some of which will come from reducing reliance on outside consultants, but spending will still rise substantially when compared to 2025, from £648.6m. to £678.04m.

Elsewhere, there are measures targeted at helping the rental market, one is removing what was essentially a tax penalty if buying a buy-to-let property and another more immediate tax relief for landlords paying for repairs.

Policy & Resources President Lindsay de Sausmarez was keen to draw a distinction between the longer term work on whether to move forward with the GST package endorsed by the last States or an alternative approach which could include corporate tax reform, and this year’s shorter term Budget.

“We know that we've got structural deficits, which mean that we need to make some fundamental changes to the balance of income and expenditure, and that can only be delivered through the tax reform work,” she said.

“In the meantime, we need to make sure that committees have got a budget to be able to continue to deliver the public services that we as a community need from them.

"And so the 2026 Budget looks at this year coming basically in isolation, in the full knowledge that actually it's not addressing some of those fundamental questions which really do need to be addressed.”

It was important to start the term with discipline to give the community confidence that they were not wasting taxpayers’ money, she said.

“We know that the cost pressures are increasing, but we need to make sure that we are spending money as responsibly as possible and getting the best possible value for money as well,” she said.

“Whether we're an individual or a household or a business, you’re quite likely to be feeling the pinch at the moment, so we need to be able to demonstrate that kind of discipline. And we're also aware that, as with any large organisation, you often get into a comfort zone about how things work.

“We've got this alignment of a new head of public service and a new political intake and quite a new looking P&R, and we’re really keen to challenge some of the ways in which we have worked historically.

“We haven't had time to lift up the bonnet and really get stuck in in time for the 2026 Budget, but we have done enough work to give us confidence that we can deliver £4million worth of savings in 2026 and that will be part of a structured program that will continue to deliver savings going forward.”

The primary area of focus for 2026 is reducing the amount of work that is commissioned out to consultants.

“Quite often in the States, in my experience, certainly we commission reports to tell us things that we already know, and actually the answers are already within the corporate knowledge of the organisation. Sometimes we just do that as a bit of a comfort blanket.

“It's that kind of expenditure that is not necessary. We need to have confidence when we know the solutions.”

The target amounts to £2.5m. in 2026 and another £1.5m to come from projects which go across more than one year.

Rental market measures

One of the more eye-catching measures aimed at the housing market is removing an additional 2% of document duty that had applied when purchasing a buy-to-let property.

“We know from experience that it's had some unintended negative impacts on the rental sector.”

There are housing pressures across the sectors in Guernsey, she said, but the most pressure was on our rented sector.

“When you look at the trajectory of rents, we've seen a relentless increase year on year, and it is a really worrying level.

"One of the factors fueling that situation is the fact that we don't have enough rented housing stock to necessarily meet the demand.

"We know that estate agents can barely advertise properties at the moment, because they go before they're even advertised. It's that tight. The under supply of rented homes is what is fueling the disproportionate increase in rents.”

She said that the States’ previous decision had inadvertently created a problem that did not used to exist.

“We know that we've got many landlords in Guernsey who are of an age where, quite understandably, they want to take it a bit easier. They might want to cash in their assets and retire.

“When they put that rented property on the market, in order for it to stay within the rented sector, a buyer is going to have to be prepared to pay an additional 2% to keep it in the rented sector.

"So actually, what's more likely to happen is that it moves into the private owner occupier sector, and what that means is that we're losing stock out of our rented sector and into a different sector, and that just puts more and more pressure on the renters themselves, because the more of a mismatch there is between demand and supply, the more rents are going to go up to reflect that.”

P&R also wants to remove another tax barrier to investing in the upkeep of rental property by moving an income tax exemption that was calculated on the average of five year’s worth of maintenance spend to instead being worked out against what is spent in that tax year.

Other measures in brief

Elsewhere, the policy of withdrawing mortgage interest relief will continue, with the limit of what it applies to reducing from £3,500 to £2,500 in 2026.

Commercial TRP will rise by inflation plus 1.7%, alcohol duty rates in line with inflation (the equivalent of 1.7p on a pint of beer), and there is also an above-inflation increase in Vehicle First Registration Duty (RPIX+5%, an increase ranging from £5 for the least polluting cars to £214 for the most polluting).

Committees had submitted spending plans that amounted to another £16m. worth of spending on top of what has been agreed.

An uncertain waiting game on corporate tax income

Among the uncertainties highlighted in the Budget is the difficulty of knowing exactly how much income will be coming from the corporate sector.

The OECD’s Pillar Two framework aims to ensure businesses with global revenues above €750 million pay a minimum effective tax rate of 15% on income within each jurisdiction in which they operate.

Guernsey has implemented this, but is currently estimating what income to expect and will not actually receive any cash until 2027, even though it is being used within each year’s Budget setting.

The States believes it will get £39m. in 2025 (up £9m. on its previous calculations) and has budgeted for £40m. for 2026.

“Projections of revenues from the implementation of Pillar 2 will be based on secondary data sources until the first round of reporting is completed in 2027.

"Assumptions have been made regarding the expected level of behavioural change; should this be different than anticipated, actual revenues could be higher or lower than the provision made."

After adjusting the operating surplus for this and other non-cash items such as depreciation, and factoring in the estimated cash requirements for capital expenditure and the unincorporated trading entities, the 2026 Budget “results in a real and material cash impact - an estimated net cash outflow of approximately £115m. This represents a significant draw on available cash resources.”

The 2026 Budget will be debated by the States on Tuesday 4th November.

Comments ()