Average rental prices approaching £8,400 a year more than they were five years ago

- The average monthly rental price for Local Market properties was £2,075, up 0.3% from the previous quarter and 5.3% compared to Q2 2024.

- This is nearly £700 a month more than five years ago

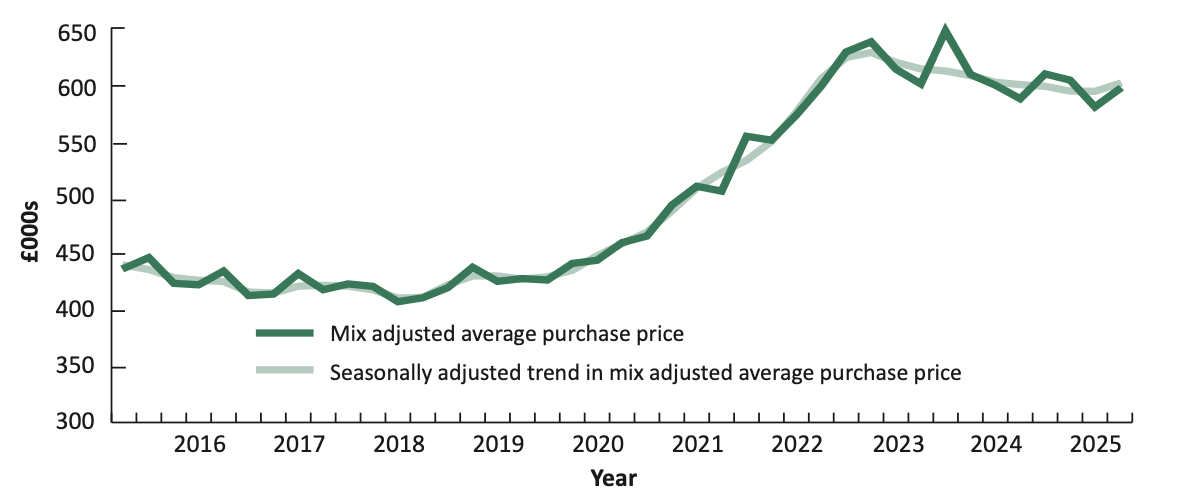

- The mix adjusted average purchase price for Local Market properties is £596,573, reflecting a 2.8% increase from the previous quarter.

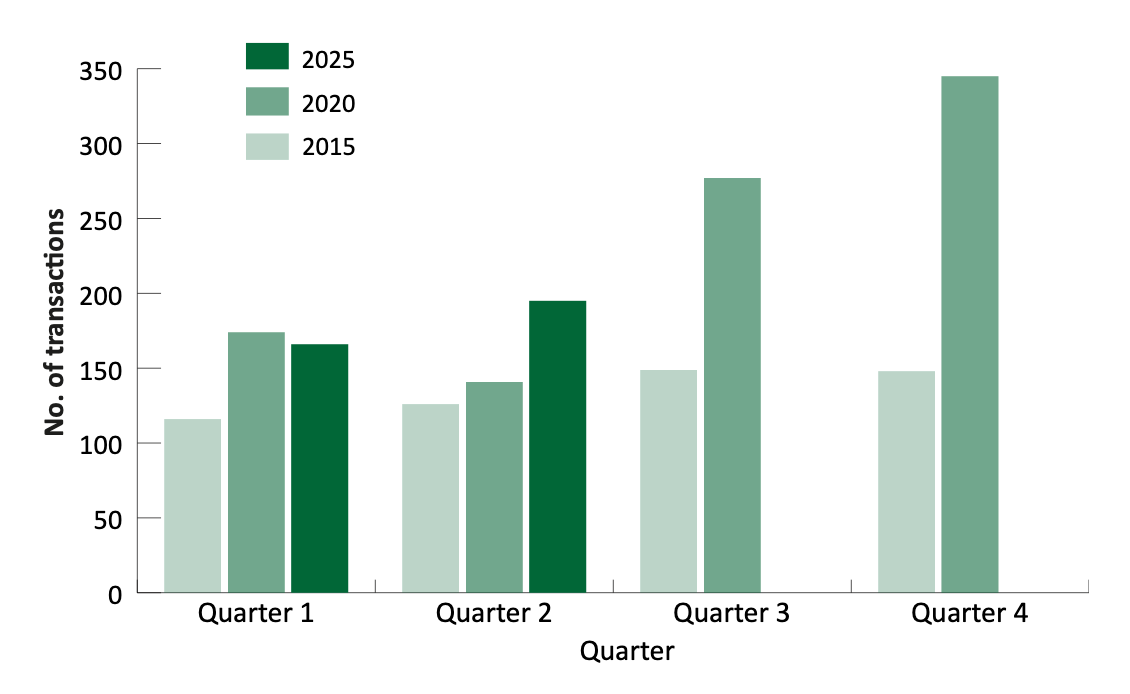

- There were 195 Local Market transactions in Q2 2025, an increase of 29 from Q1 2025 and 50 from Q2 2024.

- The average time to sell a Local Market property rose to 259 days in Q2 2025 from 202 days in Q2 2024.

Average rental prices are now approaching £8,400 a year more than they were five years ago.

The States this morning published the last housing data.

What the expert says

Richard Hemans, IoD Guernsey’s lead on economics, comments:

‘Guernsey’s local market property prices rose again in Q2 2025, with the mix-adjusted average now standing at £596,573 — up 2.8% on the quarter and 1.5% higher than this time last year. However, underlying prices remain weak, with the four-quarter rolling average down by 2%, only a slight improvement from the 3% decline reported in Q1 2025. Jersey’s housing market is even more subdued, with its rolling four-quarter House Price Index down by 6% compared to Q2 2024. In real terms, prices are likely declining faster than these headline figures suggest, given that inflation remains elevated.

However, this softness in prices is translating into strength in market activity in both islands. There have been 714 local market transactions in Guernsey over the last 12 months, representing a year-on-year increase of 36%. If anything, activity is accelerating, as growth was 19% in Q1 2025. Jersey saw year-on-year growth of 24%. These rising transaction volumes alongside modest price falls suggest increased liquidity and a market that is still normalising post-pandemic.

Guernsey’s open market remains very robust, with both prices and volumes growing strongly. Open market prices rose by 16% on a rolling four-quarter average basis, while the number of transactions increased by 50%. Guernsey is clearly maintaining its appeal as a destination for high-net-worth individuals, likely driven by its stability, quality of life, and tax environment.

Rental costs continue to climb. Guernsey’s mix-adjusted average rent rose to £2,075 per month, up 7% on a four-quarter rolling basis. Rental costs remain painful, consuming a significant proportion of average earnings, and stand in stark contrast to Jersey, where rents have fallen 0.5% year-on-year. Rents are likely rising faster than wages in Guernsey, pushing housing costs further out of reach for many and contributing to the island’s persistently high inflation rate. Housing unaffordability may increasingly restrict labour mobility and act as a brake on productivity and economic growth.

On affordability, Guernsey’s median loan-to-value (LTV) ratio sat at 79%, higher than Jersey’s median of 73%. This reflects the need to borrow more in Guernsey to purchase a home, indicating that homebuyers may be more indebted and have less equity in their property. It may also reflect reduced household savings buffers, as renters struggle to accumulate deposits amid persistently high rental costs. However, this figure does not tell us about the affordability or risk profile of those loans, since this data has not been updated since Q2 2024.

Supply remains tight. Over the past 12 months, Guernsey’s housing stock increased by just 88 units, with a net gain of only 17 in Q2, falling far short of the annual target of 310. While population growth and net inward migration have previously been cited as major contributors to housing demand, recent government analysis suggests that these figures may have been overstated due to under-reported outward migration. Revised statistics are expected to reduce the total population estimate by up to 3%. Even so, rents and prices continue to rise, suggesting that supply constraints remain the dominant force behind affordability pressures.

Looking ahead, easing interest rates may improve access for committed buyers. Yet without accelerated planning reform, expanded housing committee action and the rapid scaling of supply, especially affordable and social units, price pressures and rental inflation will remain structurally entrenched. While Jersey’s housing market also remains relatively unaffordable, falling prices to buy and to rent suggest that a stronger supply response may be helping to ease pressure. Guernsey’s experience also underlines the need for accurate and timely population data to inform housing policy and build public trust.’

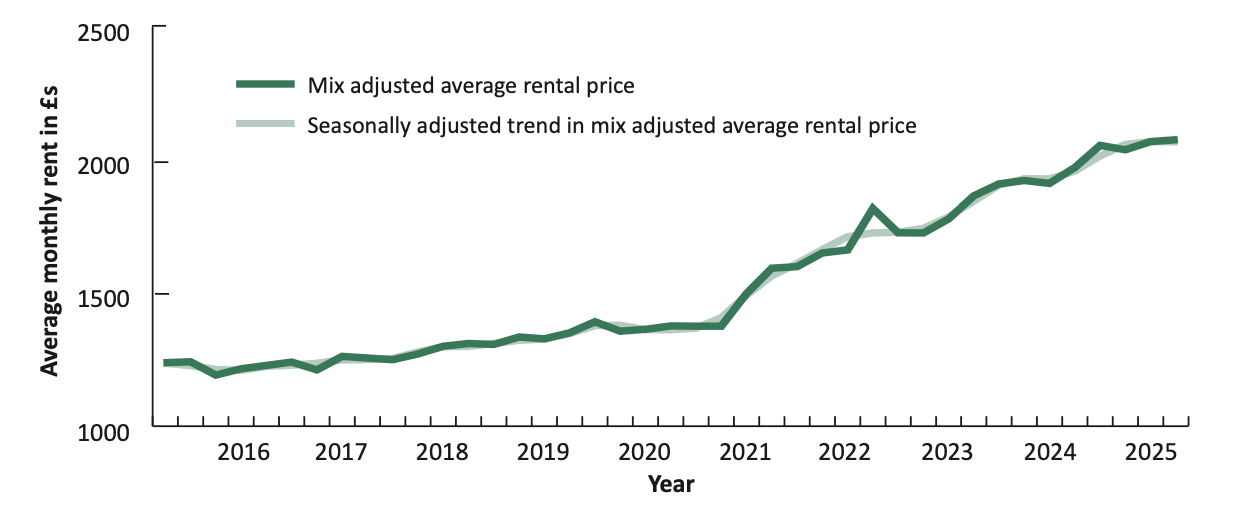

The mix adjusted average rental price for Local Market properties has reached £2,075 per month, marking a 0.3% increase from the previous quarter and a 5.3% increase compared to the same quarter last year.

By comparison, this quarter in 2020 the average was £1,376 a month, so they are 50.8% higher.

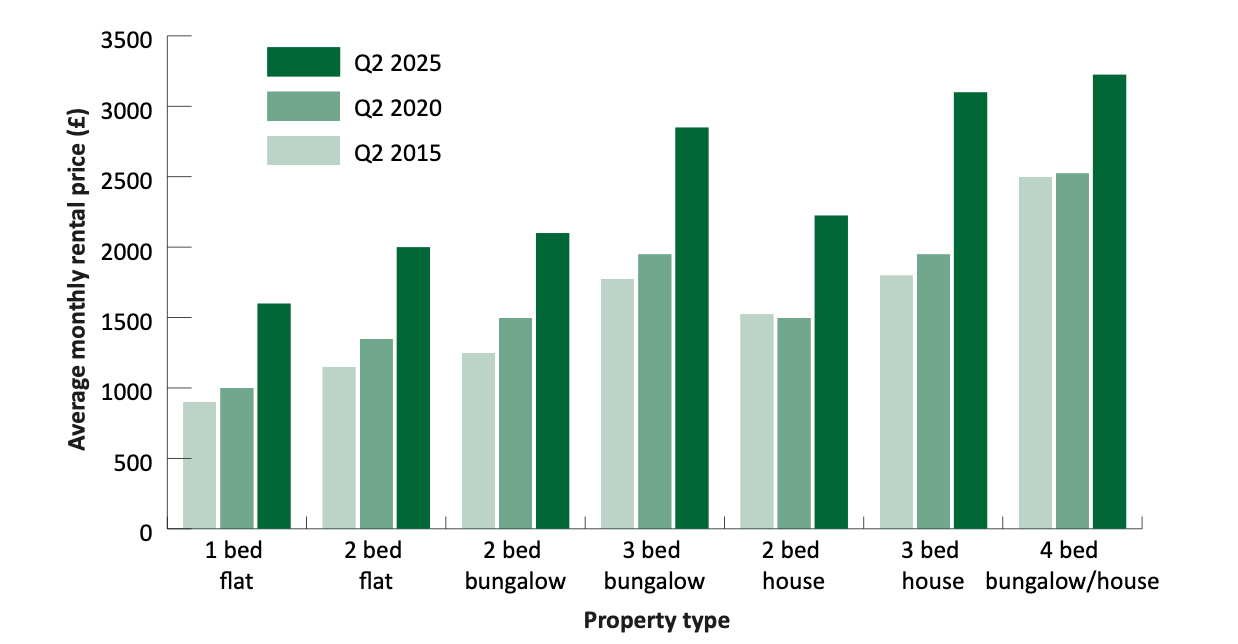

The rises are seen across all types of properties, from one bed flats to four bed houses and are noticeably higher in the last five years than the five years before that.

Average rental prices have now outstripped inflation for the last eight quarters.

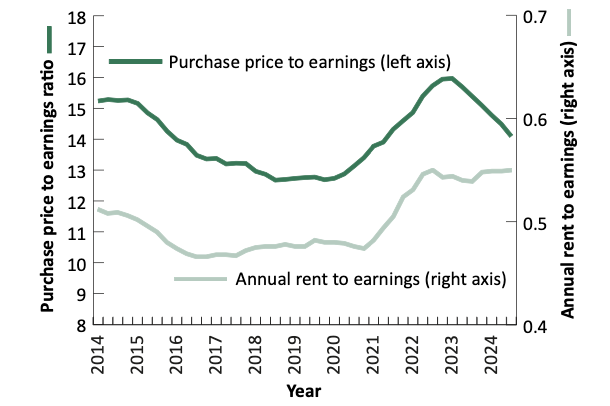

Figures comparing median earnings to rental prices, an indication of affordability, have generally levelled off since a steep rise between 2021 and 2023, although it should be noticed that median earnings figures early in that period were impacted by the loss of more lower paid than higher paid roles during Covid.

By comparison, the proportion of someone’s earnings they spend when buying a home has been falling.

The Guernsey Residential Property Prices Bulletin for the second quarter of 2025 also highlights notable trends elsewhere in the property market.

The mix adjusted average purchase price for Local Market properties stands at £596,573, representing a 2.8% increase compared to the previous quarter and a 1.5% rise from the same period last year.

This reflects a strong market recovery over five years as the four-quarter average increased by 29.7%.

The Local Market mix adjusted average purchase price is a measure of the average cost (including both realty and personalty) of purchasing a property in Guernsey.

Realty relates to fixed assets, e.g. buildings and land, and personalty is the term used for the moveable assets, such as carpets, fixtures and fittings.

The mix adjusted average prices include a measure of personalty, which is included in most property purchases, better reflecting the actual prices paid.

The report indicates that there were 195 Local Market transactions in Q2 2025, a rise of 29 from Q1 2025 and 50 higher than Q2 2024.

The average duration for a Local Market property to be sold has reached 259 days, an increase from 202 days in Q2 2024 and 241 days in Q2 2020.

Analysis indicates that the final sale prices of Local Market properties were typically 7.3% lower than the maximum advertised prices, a minor change from 8.9% discounts in the previous year and 6.4% in Q2 2020.

The report notes that 3.1% of Local Market purchases during this quarter were new builds, up from 2.1% last year.

The report also provides data on Open Market transactions, where the raw median price for the 12 transactions this quarter was £1,569,750, down from £1,803,750 a year prior.

See the full report here.

Comments ()